BLOG

Stop Letting Cash Flow Delays Slow Your Growth

2 min. read

Sep 11, 2025

You’ve landed the order you’ve been chasing for months. It’s a huge PO from a major retailer. Your team is buzzing, your suppliers are lined up, and your marketing plan is ready to roll. Then reality hits:

- The retailer’s payment terms are Net 60.

- Your suppliers wanted their money yesterday.

- And last week’s deduction dispute just locked up tens of thousands of dollars with no resolution in sight.

If you’ve ever had to slow production, delay a launch, or walk away from a bulk discount because your cash was tied up, you know the frustration. Growth opportunities in CPG move fast, but cash flow rarely keeps pace.

What if you didn’t have to choose between seizing a big opportunity and protecting your liquidity?

The Hidden Growth Tax of Waiting

Every week you wait for receivables to clear, your cost of growth goes up:

- Missed early-pay discounts mean you pay more for the same goods.

- Stockouts erode hard-won shelf space and brand loyalty.

- Lost marketing windows mean campaigns launch too late to capture peak demand.

For emerging brands, these aren’t inconveniences, they’re competitive setbacks. In high-growth mode, the ability to move quickly isn’t optional. It’s the edge that decides who wins the next retail reset, seasonal promo slot, or influencer-driven sell-out.

How Growth-Focused Brands Are Skipping the Wait

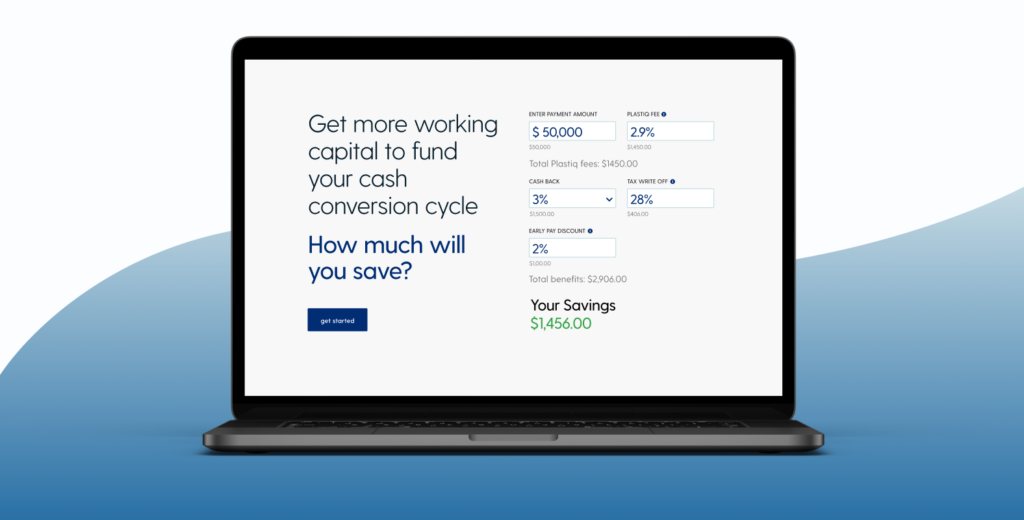

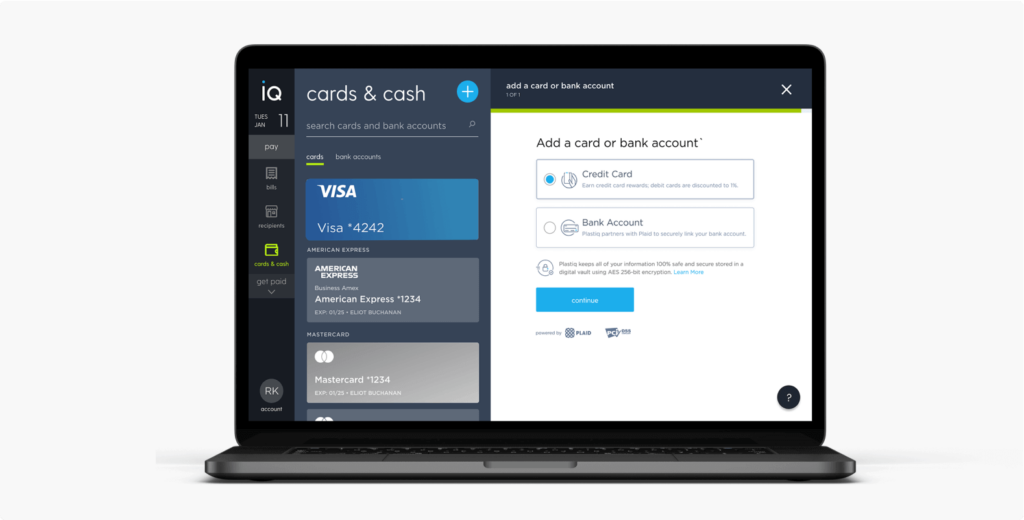

Some of today’s most nimble CPG founders are using Plastiq to bypass cash flow bottlenecks altogether. Plastiq is a payment platform that lets you pay any supplier, manufacturer, or service provider using your existing credit even if they don’t take cards.

Here’s how it works:

- Pay with your credit card through Plastiq for virtually anything including supplier invoices, production costs, or marketing spend.

- Plastiq delivers the payment to your vendor their preferred way (ACH, wire, or check).

- You keep your cash longer, often gaining up to 60 days of float.

That extra runway gives you breathing room to:

- Resolve deduction disputes without stalling production.

- Secure bulk-buy discounts from suppliers.

- Launch marketing campaigns during peak demand instead of missing the window.

- Smooth out seasonal swings without pulling from reserves.

This isn’t about patching over cash flow problems. It’s about using your available credit strategically to accelerate the things that actually grow your brand like product launches, retail expansions, and market awareness without waiting for slow-moving payments to catch up.

More Than a Stopgap, It’s a Growth Tool

In a category where speed to shelf and speed to market matter as much as product quality, eliminating payment lag can be the difference between dominating a season and missing it entirely.

Stay up to date!

Don't miss out on new features, announcements, and industry trends by subscribing to our newsletter.